Sarah Martinez still remembers the day her family’s maple syrup business nearly collapsed. The small Vermont producer had been selling premium syrup to Canadian distributors for over a decade when Trump’s tariffs on Canada suddenly made their products too expensive for their northern neighbors.

“We lost 40% of our revenue overnight,” Sarah recalls, her voice heavy with the memory. “My grandfather started this business in 1952, and for the first time in three generations, we weren’t sure we’d survive another year.”

Stories like Sarah’s played out across countless American businesses when Trump’s tariffs on Canada disrupted decades of smooth trade relations. Now, the US House of Representatives has voted to overturn these controversial trade barriers, potentially offering relief to thousands of businesses and consumers on both sides of the border.

A Historic Congressional Vote Changes Everything

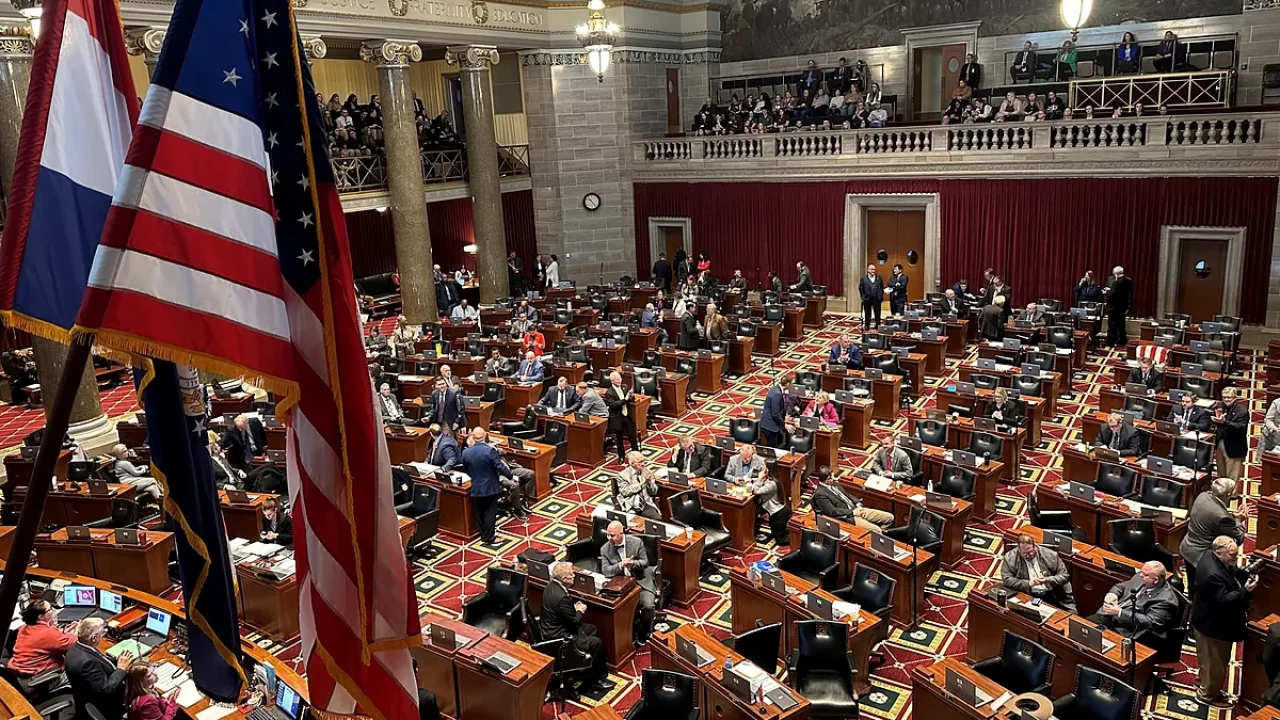

The House voted 267-158 to eliminate Trump’s tariffs on Canada, marking a significant shift in American trade policy. This bipartisan effort gained momentum as lawmakers witnessed the real-world damage these trade barriers inflicted on their constituents.

The tariffs, originally implemented in 2018 under the guise of national security, primarily targeted Canadian steel, aluminum, and lumber imports. What started as a negotiating tactic quickly evolved into a trade war that hurt American manufacturers, construction companies, and consumers who relied on affordable Canadian materials.

“These tariffs were supposed to protect American jobs, but they ended up costing us more than they saved,” explained Representative James Thompson, who co-sponsored the legislation. “We’ve seen the data, and we’ve heard from our constituents. This policy simply didn’t work.”

The vote represents more than just policy change—it signals America’s recognition that economic nationalism sometimes backfires spectacularly. Canadian goods became artificially expensive for American buyers, while retaliatory Canadian tariffs hurt American exporters like Sarah’s maple syrup operation.

The Numbers Tell a Devastating Story

The economic impact of Trump’s tariffs on Canada extended far beyond what policymakers initially anticipated. Here’s what the data reveals about this failed trade experiment:

| Sector | Tariff Rate | Job Losses | Price Increase |

|---|---|---|---|

| Steel | 25% | 75,000 | 8-12% |

| Aluminum | 10% | 23,000 | 5-7% |

| Lumber | 20% | 44,000 | 15-20% |

| Agricultural Products | 8-15% | 31,000 | 3-8% |

The consequences rippled through multiple industries:

- Construction costs soared as lumber prices reached historic highs

- Automotive manufacturers struggled with expensive steel and aluminum inputs

- Food processors faced higher costs for Canadian agricultural imports

- Energy companies paid more for Canadian oil and natural gas equipment

- Small exporters lost access to their largest foreign market

“We estimated that these tariffs cost the average American household about $850 per year in higher prices,” noted economist Dr. Maria Santos from the Peterson Institute. “That’s real money coming out of working families’ pockets for a policy that didn’t achieve its stated goals.”

The geographic impact wasn’t evenly distributed either. Border states like Michigan, New York, and Washington suffered disproportionately, as their economies were deeply integrated with Canadian supply chains.

Real Families Feel the Relief

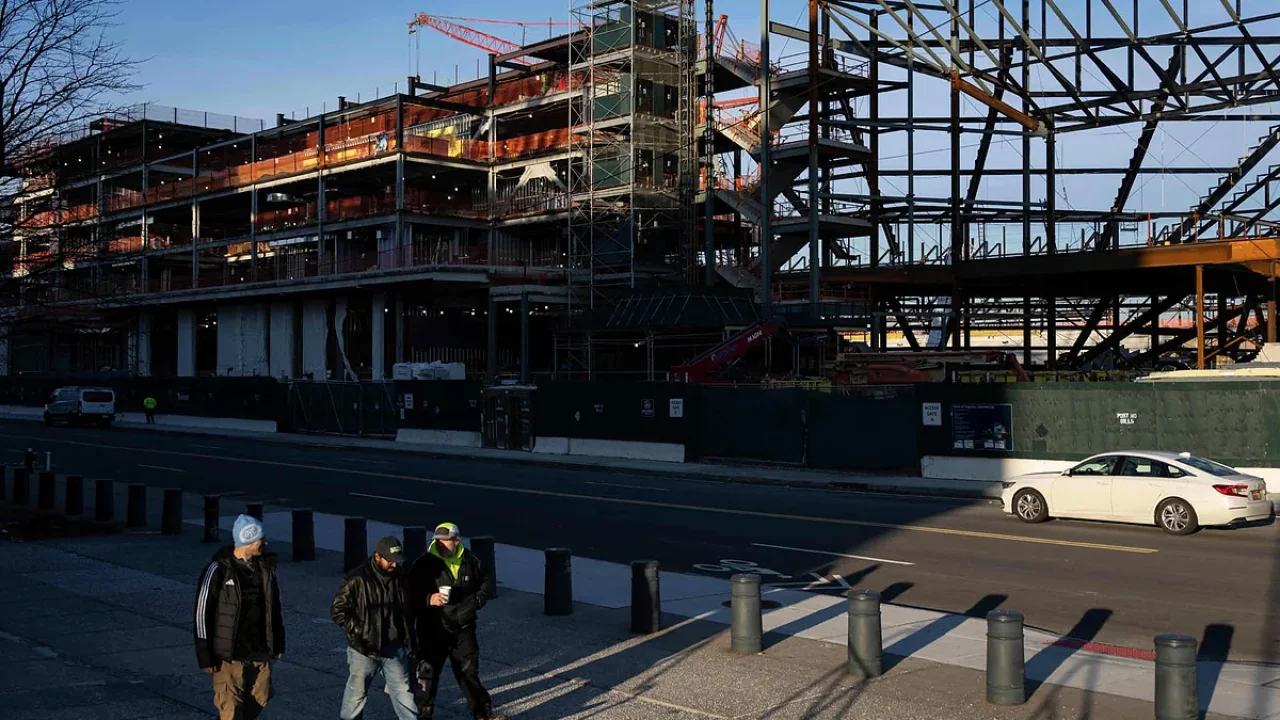

For people like Tom Richardson, a construction contractor in Buffalo, the House vote couldn’t come soon enough. His company specializes in residential renovations, and lumber costs had been killing his business for years.

“I’ve had to turn down jobs because homeowners simply couldn’t afford the inflated material costs,” Tom explains. “Some projects that used to cost $15,000 were suddenly $22,000 just because of lumber prices. Families couldn’t justify those numbers.”

The ripple effects touched unexpected corners of American life. Teachers noticed fewer families could afford home improvements that created construction jobs for their students’ parents. Real estate agents saw housing starts decline as builders struggled with material costs. Even food prices rose as Canadian agricultural imports became more expensive.

Lisa Chen, who runs a specialty food import business in Seattle, watched her Canadian suppliers struggle to maintain their American customer base. “Some of my favorite Canadian cheese producers just couldn’t compete anymore,” she says. “American consumers lost access to products they’d enjoyed for decades.”

The personal stories behind the economic statistics reveal why 267 House members ultimately decided these tariffs had to go. Trade policy isn’t just about abstract economic theory—it’s about real people trying to make a living and provide for their families.

“When I see my neighbors struggling to afford basic home repairs because lumber costs doubled, I know we need to fix this,” said Representative Susan Walsh, whose district borders Canada. “Good policy should make life easier for working families, not harder.”

The Senate now faces pressure to follow the House’s lead, though the timeline remains uncertain. President Biden has indicated support for removing these tariffs, viewing them as relics of a failed approach to international trade relations.

Meanwhile, Canadian officials have expressed cautious optimism about restoring normal trade relationships. Prime Minister Justin Trudeau called the House vote “an encouraging step toward rebuilding the strong economic partnership our countries have always shared.”

For Sarah Martinez and her maple syrup business, the vote brings hope for the first time in years. “Maybe we can finally start rebuilding those Canadian relationships we lost,” she says. “Our families depend on trade working both ways across that border.”

FAQs

What exactly were Trump’s tariffs on Canada?

These were additional taxes on Canadian steel (25%), aluminum (10%), lumber (20%), and various agricultural products (8-15%) that made Canadian imports more expensive for American buyers.

Why did the House vote to remove these tariffs now?

Lawmakers saw clear evidence that the tariffs were hurting American businesses and consumers more than they were helping, with job losses exceeding job gains and higher prices for families.

Will prices immediately drop once the tariffs are removed?

Price reductions will likely take several months as supply chains adjust and competition returns to normal levels, but consumers should see gradual improvements.

What happens if the Senate doesn’t pass similar legislation?

The tariffs would remain in place, though President Biden has executive authority to reduce or eliminate some trade barriers without Congressional approval.

How much money did these tariffs actually collect?

The tariffs generated approximately $7.2 billion in revenue for the US Treasury, but economists estimate they cost the American economy over $40 billion in lost productivity and higher consumer prices.

Will Canada remove its retaliatory tariffs on American goods?

Canadian officials have indicated they’re prepared to eliminate retaliatory measures once the US removes its tariffs, potentially restoring normal trade relationships between the two countries.