Maria had just finished her evening shift at a Prague factory when the lights flickered. For a split second, the entire industrial district went dark before humming back to life. She didn’t think much about it—power grids are complex, after all. But that brief moment represented something much bigger happening across Europe.

What Maria witnessed was the delicate dance of modern electricity systems, where traditional power plants must constantly balance the unpredictable flow of wind and solar energy. Now, a massive corporate deal is reshaping who controls that dance, and it could change how Europeans get their electricity for decades to come.

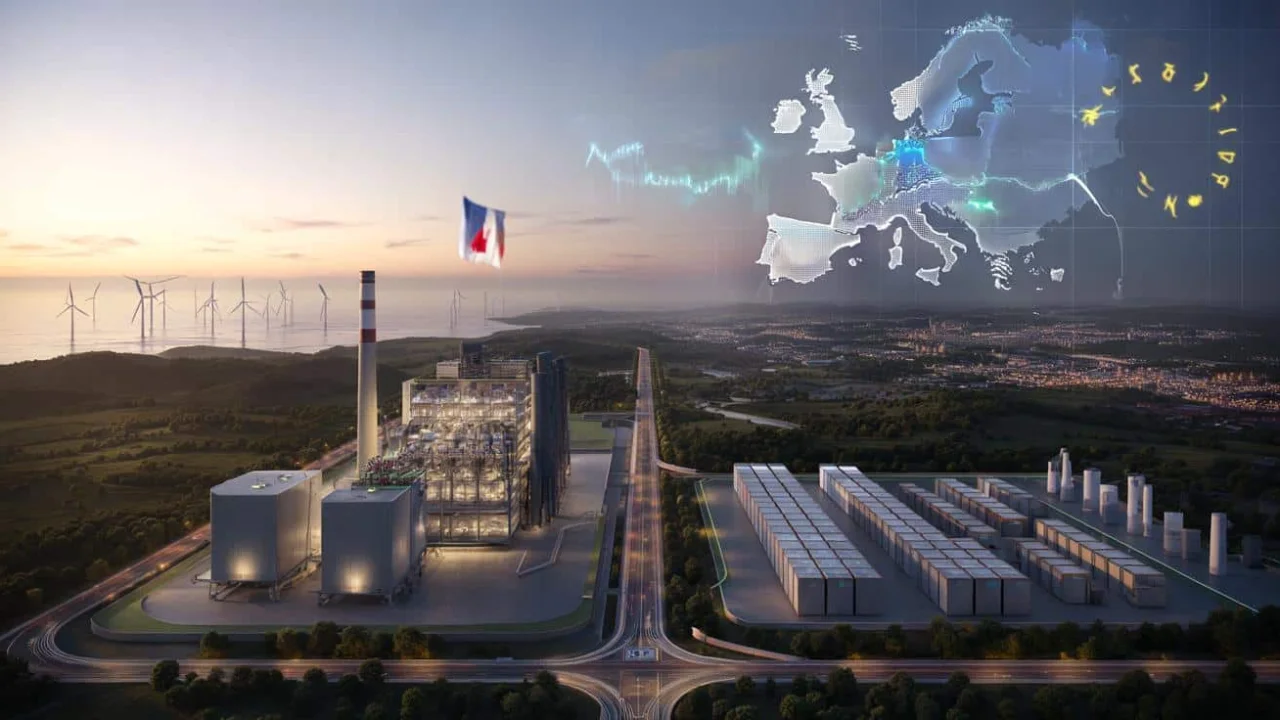

The TotalEnergies takeover of Czech energy giant EPH’s flexible power assets represents one of the biggest energy deals in recent European history. This €5.1 billion transaction isn’t just about money—it’s about control over the infrastructure that keeps our lights on when the wind doesn’t blow and the sun doesn’t shine.

How This Massive Deal Is Changing Europe’s Energy Landscape

TotalEnergies, France’s energy heavyweight, has just pulled off a strategic masterstroke. Instead of simply buying EPH’s assets with cash, they’re issuing 95.4 million new shares worth €53.94 each. This means EPH becomes a major TotalEnergies shareholder with 4.1% of the company, creating a partnership that goes far beyond a typical acquisition.

“This isn’t your standard takeover,” explains energy analyst Dr. Sarah Hoffman. “TotalEnergies is essentially marrying their gas expertise with EPH’s flexible power infrastructure. They’re building something completely new.”

The deal brings together assets worth approximately €10.6 billion under a new joint structure. These aren’t just any power plants—they’re the flexible facilities that can ramp up quickly when renewable energy sources fall short. Think of them as the backup singers that jump in when the lead vocalist (renewables) needs support.

EPH, founded in 2009, built their empire by buying what others didn’t want: aging thermal plants, gas facilities, and infrastructure that major utilities were eager to shed due to climate pressures. While competitors chased shiny new solar farms, EPH quietly assembled a portfolio of assets that remain critical for grid stability.

The transaction is expected to close by mid-2026, pending regulatory approvals and employee consultations. Once completed, it will place significant European electricity capacity under partial French control at a time when energy security has never been more important.

What Assets Are Actually Changing Hands

The scale of this TotalEnergies takeover becomes clearer when you examine what’s included. EPH’s portfolio spans multiple countries and technologies, creating a diverse energy platform that complements TotalEnergies’ existing operations.

Here’s what the deal encompasses:

- Gas-fired power plants across Central and Eastern Europe

- Combined heat and power facilities serving industrial customers

- Thermal power stations with rapid-response capabilities

- Energy storage and battery systems

- District heating networks in major European cities

- Gas pipeline infrastructure and storage facilities

| Asset Type | Capacity | Key Countries |

| Gas Power Plants | 8.2 GW | Czech Republic, Slovakia, Germany |

| Coal Plants (transitioning) | 3.1 GW | Germany, Czech Republic |

| Heat Generation | 2.8 GW | Slovakia, Hungary, Italy |

| Battery Storage | 450 MW | UK, Germany, Netherlands |

“The beauty of EPH’s portfolio is its flexibility,” notes energy consultant Michael Torres. “These aren’t base-load dinosaurs—they’re the facilities that can respond within minutes when grid operators need them.”

The strategic value becomes obvious when considering Europe’s renewable energy goals. As countries add more wind and solar capacity, they desperately need backup power that can activate quickly during calm, cloudy periods. EPH’s assets provide exactly that capability.

This TotalEnergies takeover also includes valuable gas infrastructure, including pipeline networks and storage facilities. In a post-2022 energy crisis world, controlling gas supply chains has become a matter of national security for European governments.

Real-World Impact on European Energy Markets

For ordinary Europeans like Maria, this deal could mean more stable electricity prices and improved grid reliability. The combined entity will have unprecedented ability to balance supply and demand across multiple countries and energy sources.

The timing couldn’t be more crucial. Europe is racing to reduce fossil fuel dependence while maintaining energy security. This TotalEnergies takeover creates a company uniquely positioned to manage that transition by combining French nuclear expertise with flexible European power assets.

Industrial customers stand to benefit significantly. Manufacturing companies that require reliable, controllable power supplies now have access to a more integrated energy provider. The combined heat and power facilities are particularly valuable for industries that need both electricity and steam for their operations.

“We’re seeing the birth of a new type of energy company,” observes industry veteran Dr. Elena Kowalski. “One that can offer everything from molecules to electrons, from baseload to peak power, from heating to cooling.”

The deal also strengthens France’s influence over European energy markets. While the EU promotes energy market integration, having major infrastructure under the control of a French company could raise some eyebrows in Brussels and other European capitals.

For investors, this TotalEnergies takeover represents a bet on the continuing importance of flexible fossil fuel assets during the energy transition. While renewable capacity grows rapidly, backup power remains essential until battery technology can provide grid-scale storage at competitive prices.

The share-based structure of the deal aligns both companies’ interests for the long term. EPH’s founders and investors now have significant skin in TotalEnergies’ overall success, creating incentives for genuine cooperation rather than just a financial transaction.

Grid operators across Europe will likely welcome the combination. Having a single entity that can coordinate flexible capacity across multiple countries should improve system reliability and reduce the need for expensive emergency interventions during supply shortfalls.

Environmental groups may have mixed reactions. While the deal doesn’t directly add fossil fuel capacity, it does consolidate control over existing thermal assets that will likely operate for years to come as backup power sources.

Looking Ahead: The New European Energy Reality

This TotalEnergies takeover signals a broader trend in European energy markets. As the sector transforms, successful companies need diverse portfolios spanning traditional and renewable sources, along with the infrastructure to connect and balance them all.

The next two years leading up to deal closure will be crucial. Regulatory authorities must approve the transaction, and employee representatives across multiple countries will have their say. Given the strategic importance of energy infrastructure, governments will scrutinize the deal carefully.

For Maria and millions of other Europeans, the success of this partnership could determine whether the lights stay on consistently during the challenging years ahead. The stakes couldn’t be higher, and the energy giant being born from this deal will play a central role in Europe’s energy future.

FAQs

What exactly is TotalEnergies buying from EPH?

TotalEnergies is acquiring a 50% stake in EPH’s flexible power platform, which includes gas plants, thermal facilities, and energy storage systems across Europe.

Why is this deal being paid in shares instead of cash?

The share-based payment makes EPH a major TotalEnergies shareholder with 4.1% ownership, creating a long-term strategic partnership rather than just an asset purchase.

When will the deal be completed?

The transaction is expected to close by mid-2026, subject to regulatory approvals and employee consultations across multiple European countries.

What does this mean for European electricity prices?

The combined entity should be better able to balance supply and demand, potentially leading to more stable electricity prices and improved grid reliability.

Will this deal face regulatory challenges?

Given the strategic importance of energy infrastructure, European regulators will likely scrutinize the transaction carefully, though approval seems probable.

How does this change Europe’s energy security?

The deal consolidates significant flexible power capacity under partial French control, potentially strengthening energy security but also raising questions about strategic autonomy for other EU countries.