Maria Rodriguez had been planning this moment for three years. After working nights as a nurse while perfecting her grandmother’s tamale recipes during the day, she was finally ready to open her food truck business in Austin, Texas. With her green card in hand and a solid business plan, she felt confident about applying for an SBA loan to get her dream off the ground.

Then came the call from her loan officer. “I’m sorry, Maria, but the rules just changed. Green card holders can no longer qualify for SBA 7a loans.” The news hit her like a punch to the gut. Years of preparation, tax payments, and building her credit score suddenly meant nothing.

Maria’s story isn’t unique anymore. Thousands of legal permanent residents across America are discovering that their path to small business ownership just got significantly harder.

The New Reality for Green Card Holders

The Small Business Administration dropped a bombshell in early 2024 that’s sending shockwaves through immigrant communities nationwide. Starting March 1st, permanent residents can no longer access SBA 7a loans, one of the most popular small business financing programs in the country.

This isn’t just a minor policy tweak. We’re talking about the SBA’s flagship lending program that provides up to $5 million in financing for working capital, expansion, and other crucial business needs. For many entrepreneurs, these loans represent the difference between dreams and reality.

The new rules are crystal clear and unforgiving. To qualify for SBA 7a loans now, your business must be 100% owned by U.S. citizens who live in America. No exceptions for green card holders, no allowances for foreign investors, and no wiggle room for U.S. citizens living abroad.

“This decision creates an unprecedented barrier for legal immigrants who’ve been contributing to our economy for years,” says immigration attorney Jennifer Walsh, who specializes in business immigration law.

How the Requirements Have Changed Over Time

The shift didn’t happen overnight. Let’s break down exactly how we got here:

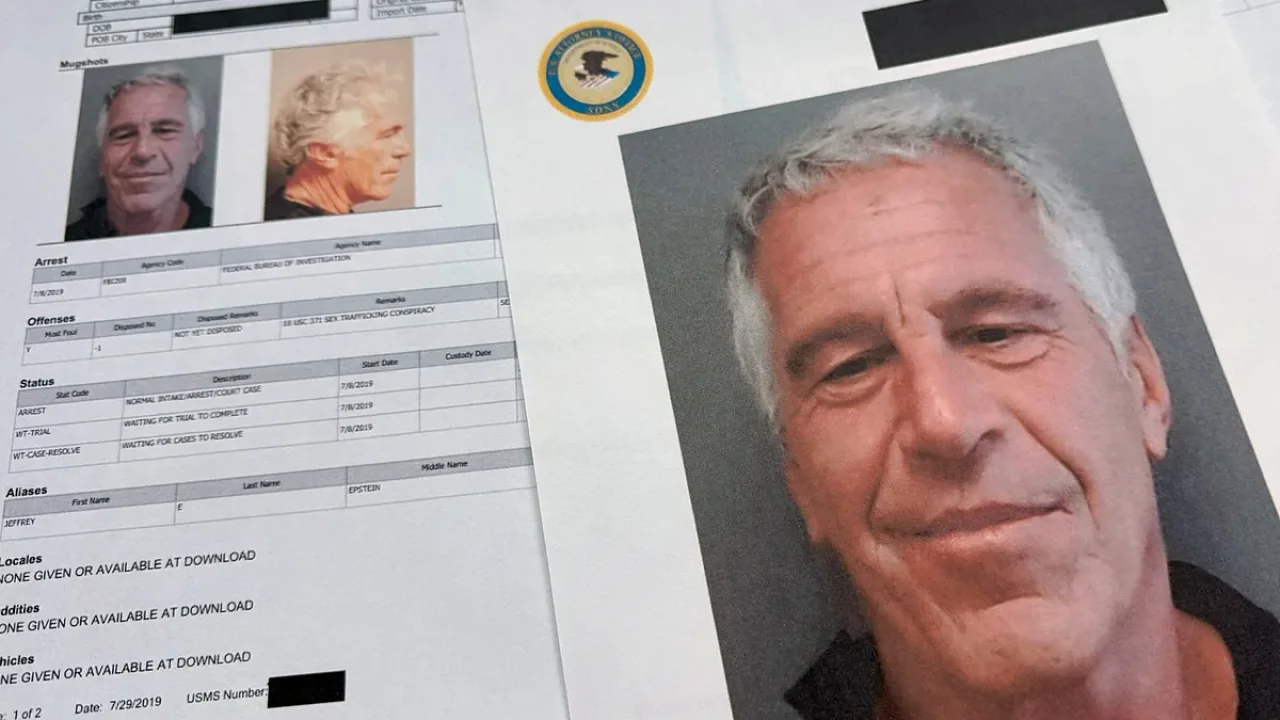

| Time Period | Ownership Requirements | Green Card Holder Status |

|---|---|---|

| Pre-Trump Administration | 51% U.S. citizen ownership required | Fully eligible |

| December 2023 | 95% U.S. citizen ownership required | Limited to 5% ownership |

| March 1, 2024 | 100% U.S. citizen ownership required | Completely ineligible |

The December changes already sent warning signals to the business community. Lenders started reporting problems with citizenship verification requirements, and loan volumes began dropping noticeably.

But the March announcement took things to a whole new level. The SBA essentially drew a line in the sand: if you don’t have a U.S. passport, you’re out of luck when it comes to their most important lending program.

Key restrictions now include:

- Zero tolerance for foreign ownership at any level

- No participation allowed for permanent residents

- U.S. citizens living abroad are also excluded

- All owners must physically reside within the United States

“We’re seeing a complete reversal of decades of inclusive lending policy,” explains small business consultant Roberto Martinez. “This affects people who’ve been paying taxes and creating jobs for years.”

Who Gets Hit Hardest by These Changes

The human impact of these policy changes extends far beyond individual entrepreneurs. We’re talking about a ripple effect that touches entire communities and economic sectors.

Consider the numbers: permanent residents who rely on SBA 7a loans represent thousands of small businesses across America. These aren’t people trying to game the system – they’re legal immigrants who’ve been playing by the rules, paying taxes, and contributing to their local economies.

The businesses most likely to feel the impact include:

- Family-owned restaurants and food services

- Retail stores in immigrant communities

- Professional services like accounting and legal practices

- Manufacturing and construction companies

- Technology startups with diverse founding teams

Democratic lawmakers aren’t staying quiet about this. Senator Edward J. Markey and Representative Nydia Velazquez have been particularly vocal in their criticism. In their joint statement, they argued that “the decision harms legal immigrants seeking to start or expand businesses in the United States.”

The political pushback has been swift and pointed. Back in December, Democratic lawmakers sent a formal letter to the SBA expressing concerns about the increasingly strict citizenship rules and the noticeable decrease in loan volumes.

But the SBA hasn’t been particularly responsive to these concerns. Lawmakers have complained about the lack of official communication from the agency, leaving business owners and lenders in the dark about future policy directions.

“The silence from the SBA is almost as concerning as the policy itself,” notes business policy analyst Sarah Chen. “Small business owners need predictability, and right now they’re getting the opposite.”

The timing couldn’t be worse for many entrepreneurs. Spring is traditionally when many small businesses look to expand or launch new ventures. With these restrictions in place, entire segments of the economy could see reduced investment and growth.

What makes this particularly frustrating for affected business owners is that many have been preparing for months or even years to apply for SBA 7a loans. They’ve built credit histories, developed business plans, and invested their own savings, only to discover that the rules changed while they weren’t looking.

The broader economic implications are still unfolding. Small businesses owned by immigrants have historically been significant job creators, often hiring from their local communities and revitalizing neighborhoods that larger corporations might overlook.

“When you cut off access to capital for legal immigrants, you’re not just hurting individuals – you’re potentially slowing down economic growth in communities that need it most,” warns economist Dr. Amanda Foster.

The March 1st implementation date is fast approaching, and there’s no indication that the SBA plans to reconsider or modify these restrictions. For entrepreneurs like Maria Rodriguez, that means exploring alternative financing options that are often more expensive and harder to obtain.

The political debate is just getting started, but for thousands of small business owners, the practical impact is immediate and real. The American dream of entrepreneurship just got a lot more complicated for anyone without a U.S. passport.

FAQs

Can green card holders still apply for other types of SBA loans?

The restrictions specifically target SBA 7a loans, but other SBA programs may have different eligibility requirements that should be checked individually.

What happens to existing SBA 7a loans held by green card holders?

Current loans should not be affected by the new rules, which apply only to new applications submitted after March 1st.

Are there alternative funding options for permanent residents?

Yes, traditional bank loans, private lenders, and investor funding remain available, though terms may be less favorable than SBA programs.

Could these rules change again in the future?

Policy changes are always possible, especially with shifting political administrations, but there’s no current indication of when or if these restrictions might be reversed.

Do these changes affect naturalized U.S. citizens?

No, naturalized citizens have the same access to SBA 7a loans as natural-born citizens, as long as they meet all other program requirements.

How can affected business owners stay informed about policy updates?

Monitor official SBA communications, work with qualified lenders, and consider joining small business advocacy groups that track policy changes.