Sarah Martinez stared at her phone screen, scrolling through TikTok during her lunch break. At 26, she was drowning in student loans and barely making ends meet on her marketing assistant salary. Then she stumbled across a video that changed everything – a young woman explaining investment strategies in the most relatable way she’d ever heard.

That woman was Vivian Tu, better known as “Your Rich BFF,” and her no-nonsense approach to personal finance had already helped millions of young people take control of their money. Now, Sarah’s story might become even more common as Amazon prepares to bring Tu’s wisdom to an even bigger audience through television.

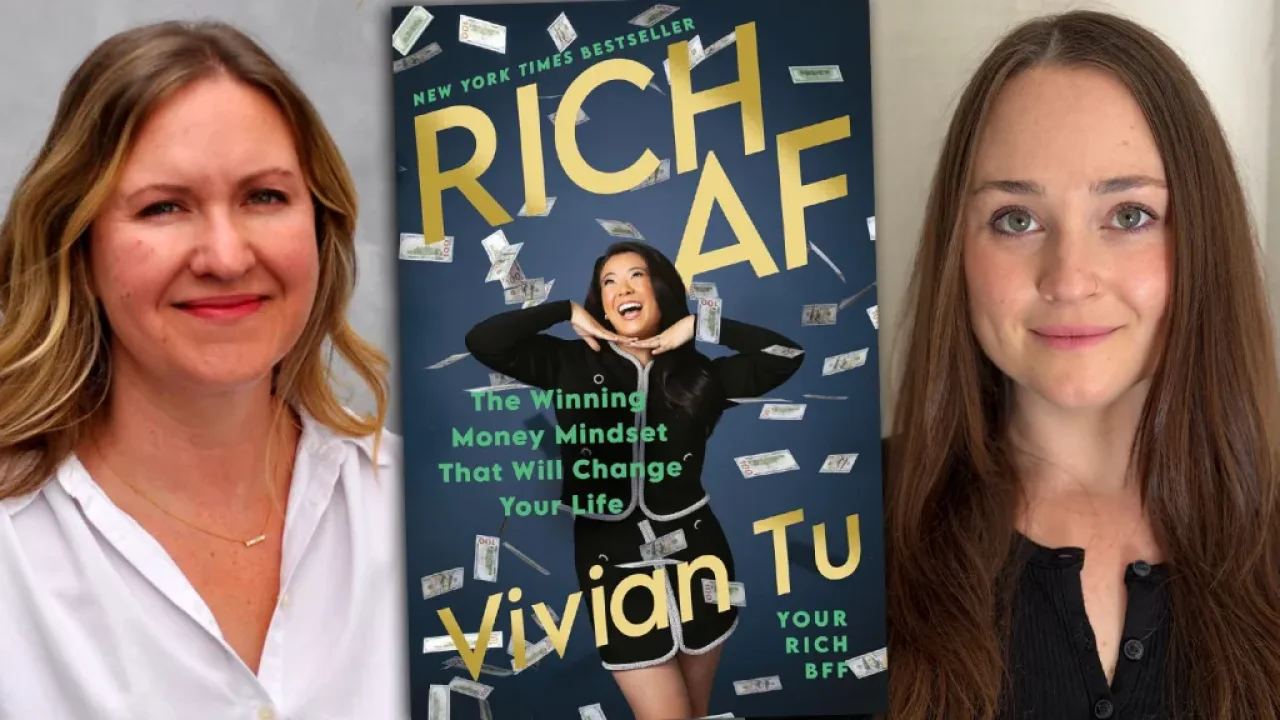

The streaming giant has officially greenlit development of the Rich AF series, based on Tu’s bestselling book “Rich AF: The Winning Money Mindset That Will Change Your Life.” This isn’t just another financial advice show – it’s a potential game-changer for how an entire generation thinks about wealth building.

The Powerhouse Team Behind the Rich AF Series

Amazon MGM Studios has assembled a dream team to bring Vivian Tu’s financial wisdom to the small screen. Mallory Rosenthal, Sarah Kucserka, and Patrick Moran from PKM Productions are spearheading the project, bringing their combined expertise in creating content that resonates with younger audiences.

“We’re not trying to create another boring financial planning show,” says an industry insider familiar with the project. “This is about making money conversations accessible and actually fun to watch.”

The Rich AF series represents a significant shift in how streaming platforms approach financial content. Rather than dry, lecture-style programming, the show promises to deliver Tu’s signature blend of practical advice and genuine relatability that made her social media presence so powerful.

PKM Productions brings a track record of developing content that speaks directly to millennial and Gen Z audiences. Their involvement suggests the Rich AF series will maintain the authentic voice that made Tu’s book a phenomenon in the first place.

What Makes This Financial Content Different

Traditional financial advice often feels disconnected from real life struggles. The Rich AF series aims to bridge that gap by addressing the specific challenges facing today’s young adults. Here’s what sets this project apart from typical money-focused programming:

- Real-world scenarios that reflect actual financial pressures facing millennials and Gen Z

- Practical strategies for building wealth on modest incomes

- Breaking down complex investment concepts into digestible, actionable steps

- Addressing the emotional and psychological aspects of money management

- Cultural sensitivity around different approaches to family finances and wealth building

The show’s development reflects Amazon’s growing focus on lifestyle and educational content that serves underrepresented audiences in the financial space. Young adults have been largely ignored by traditional financial media, creating a massive opportunity for content that speaks their language.

| Traditional Financial Shows | Rich AF Series Approach |

|---|---|

| Focus on high earners | Strategies for modest incomes |

| Complex financial jargon | Simple, relatable explanations |

| One-size-fits-all advice | Personalized strategies by situation |

| Intimidating tone | Encouraging, friend-like guidance |

“The beauty of Vivian’s approach is that she talks to you like your financially savvy best friend would,” notes a television development executive who has worked on similar projects. “She removes the shame and fear that keeps so many people from taking action with their money.”

The Real-World Impact on Viewers and Beyond

The Rich AF series arrives at a perfect storm moment for financial education. Young adults are facing unprecedented economic challenges, from inflated housing costs to stagnant wages and mounting student debt. Traditional financial institutions have failed to provide relevant, accessible guidance for this demographic.

Amazon’s investment in this type of content signals recognition of a massive underserved market. Financial literacy among young adults remains critically low, yet this generation is more open to learning through digital platforms than any before them.

The series could potentially influence how other streaming services approach educational content. Netflix, Apple TV+, and other platforms are watching closely to see how audiences respond to this blend of entertainment and practical education.

Beyond individual viewers, the Rich AF series might impact broader financial conversations. Banks and financial service companies are already taking note of Tu’s influence, with many adapting their marketing and product development to better serve younger customers who discovered investing through social media personalities like her.

“When someone with Vivian’s reach starts talking about specific investment strategies or financial products, the entire industry pays attention,” explains a financial services marketing professional. “Her endorsement can literally move markets among younger demographics.”

The show’s success could also pave the way for more diverse voices in financial media. Tu’s background as a Wall Street professional who pivoted to accessible education represents a new model for financial expertise that resonates with audiences who felt excluded from traditional wealth-building conversations.

What Viewers Can Expect From the Series

While specific details about the Rich AF series format remain under wraps, the source material provides strong clues about the show’s direction. Tu’s book focuses heavily on mindset shifts and practical action steps rather than abstract financial theory.

The series will likely feature real people working through actual financial challenges, with Tu providing guidance and expertise. This approach mirrors the success of shows like “Queer Eye” that combine expert advice with genuine human stories.

Production insiders suggest the show will maintain Tu’s signature directness while expanding on concepts that work better in longer-form content than social media clips. Topics like retirement planning, home buying strategies, and investment portfolio building require more depth than a TikTok video can provide.

The Rich AF series represents more than just another streaming show – it’s a potential catalyst for changing how an entire generation approaches money, wealth building, and financial security in an increasingly complex economic landscape.

FAQs

When will the Rich AF series premiere on Amazon?

The series is currently in development with no official release date announced yet.

Will Vivian Tu host the Rich AF series herself?

While Tu’s involvement is confirmed, specific details about her role as host haven’t been officially announced.

What topics will the Rich AF series cover?

Based on Tu’s book, expect coverage of budgeting, investing, debt management, and wealth-building strategies for young adults.

Is the Rich AF series only for people familiar with Vivian Tu’s content?

No, the series is designed to be accessible to anyone interested in improving their financial literacy, regardless of prior knowledge.

Will the Rich AF series be available internationally on Amazon Prime?

Amazon hasn’t announced international distribution plans for the series yet.

How does this series differ from other financial advice shows?

The Rich AF series focuses specifically on the financial challenges and opportunities facing millennials and Gen Z, with practical advice delivered in an accessible, non-intimidating format.