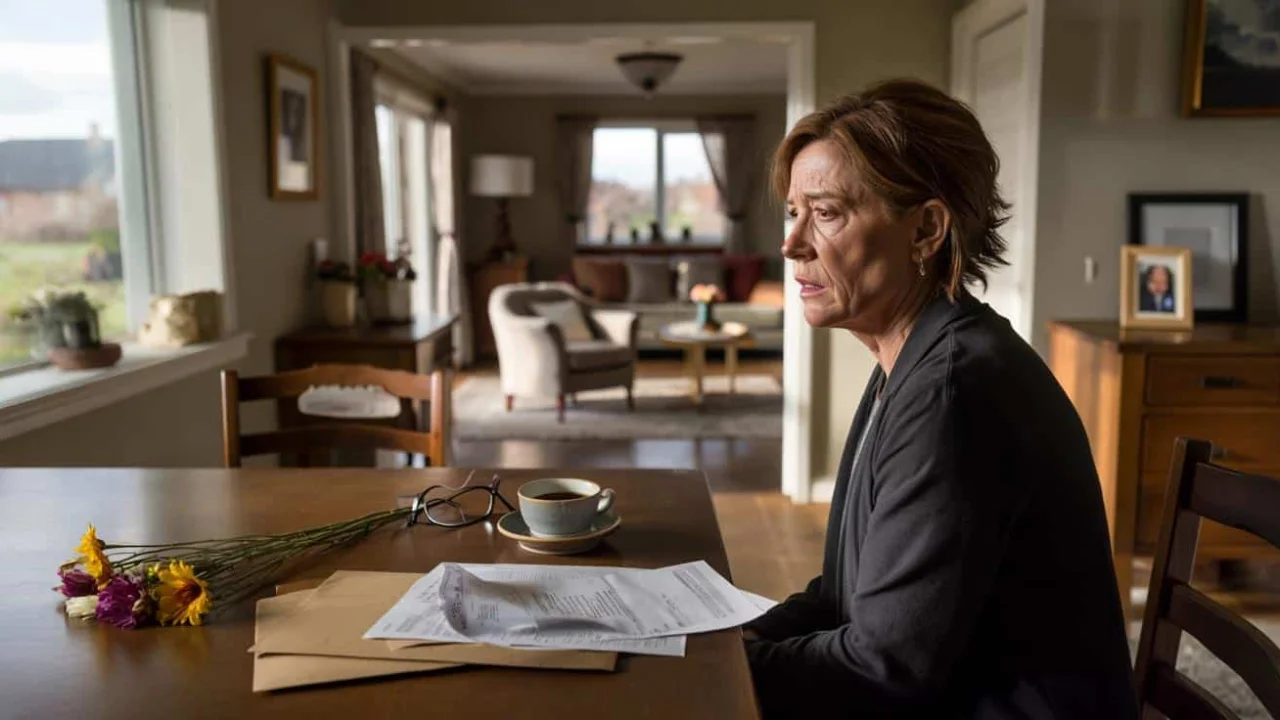

The day after the funeral, the house sounded wrong. Too quiet, like it was holding its breath. Anna walked into the kitchen, still expecting to hear the kettle whistle the way her husband used to forget it on the stove. On the table: flowers, half-finished casseroles from neighbors…and an opened brown envelope she hadn’t dared to touch. It came from the tax office.

She read the words three times before they made sense. “Inheritance tax due.” On the house. On the home they had built together. On the bricks that still smelled like him. Her hands started to shake.

“If love is priceless, why is the state billing me for it?” she whispered into the tiled silence.

When grief meets the taxman

Anna’s story isn’t unique. Thousands of widows and widowers face this cruel double blow every year. First, they lose their partner. Then they discover the government wants a cut of what’s left behind.

Inheritance tax hits when someone dies and leaves behind assets worth more than a certain threshold. In many cases, the family home pushes the estate value over that line. What was once a sanctuary becomes a financial burden during the most vulnerable time imaginable.

“I see this heartbreak constantly,” says estate planning attorney Sarah Mitchell. “Clients come in thinking inheritance tax only affects the wealthy. Then they realize their modest family home has appreciated enough to trigger a massive tax bill.”

The current system creates particularly harsh scenarios for surviving spouses. While there are spousal exemptions in many jurisdictions, these don’t always cover the full value of inherited property. The result? Grieving partners forced to sell the home they shared or scramble to find cash they don’t have.

The numbers that destroy families

Understanding inheritance tax means grappling with thresholds that often seem arbitrary to those caught in their grip. Here’s how the financial reality breaks down:

| Estate Value | Tax Rate | Average Tax Due | Impact on Survivors |

|---|---|---|---|

| $325,000 – $500,000 | 0% – 20% | $0 – $35,000 | Minor adjustments needed |

| $500,000 – $1,000,000 | 20% – 40% | $35,000 – $200,000 | May require home sale |

| $1,000,000+ | 40%+ | $200,000+ | Significant financial hardship |

These figures represent more than percentages on a government form. They translate to real decisions about whether to keep dad’s workshop, mom’s garden, or the bedroom where your spouse took their last breath.

Key factors that determine inheritance tax liability include:

- Total value of the deceased’s assets

- Relationship between deceased and beneficiary

- Available exemptions and allowances

- Timing of asset transfers before death

- Property location and local tax laws

Tax advisor James Chen explains the cruel irony: “Property values have risen dramatically, but inheritance tax thresholds haven’t kept pace. Families who bought modest homes decades ago now find themselves facing tax bills they never anticipated.”

The ripple effect nobody sees coming

Inheritance tax doesn’t just affect the immediate survivors. Its impact spreads through generations, reshaping family dynamics and financial security in ways that extend far beyond the initial loss.

Consider the Peterson family from Ohio. When their father died unexpectedly, his $780,000 estate triggered a tax bill of $91,000. The family home, worth $520,000, represented most of his assets. The choice was stark: sell the house or liquidate his entire retirement account to pay the government.

They chose to sell. The house that hosted three generations of Christmas mornings went to strangers. The money left over barely covered the mother’s moving expenses into a small apartment.

“We didn’t just lose dad,” says eldest son Mark Peterson. “We lost our gathering place, our history, our sense of continuity. The tax man took more than money – he took our ability to grieve in the place where dad lived.”

Financial planner Rebecca Torres sees these scenarios regularly: “Inheritance tax forces families to make impossible choices during their darkest hours. Sell the family business to pay the bill? Liquidate college funds? Take out loans against property you can’t afford to keep?”

The psychological toll adds another layer of complexity. Survivors often feel guilty about resenting the tax, as if grief and financial stress can’t coexist. They blame themselves for not planning better, even when the planning was impossible to foresee.

Rural families face particular challenges. Family farms and small businesses often have high asset values but low liquid cash flow. When inheritance tax comes due, these operations frequently can’t survive the financial hit. Multi-generational enterprises collapse not from poor management, but from tax obligations that exceed their ability to pay.

Estate attorney Michael Roberts notes a troubling trend: “I’m seeing more families preemptively selling family property while parents are still alive, just to avoid inheritance tax complications later. The law is literally breaking apart family legacies before death even occurs.”

The emotional cost extends to children who watch their surviving parent struggle with financial decisions that seem to dishonor their deceased spouse’s memory. Selling the family home feels like selling the last physical connection to someone they loved. Yet keeping it might mean financial ruin.

Planning ahead when tomorrow feels uncertain

While inheritance tax planning can’t eliminate the pain of loss, it can prevent financial devastation from compounding grief. The key lies in understanding options before they become necessities.

Smart planning strategies include establishing trusts, making lifetime gifts within annual exemption limits, and ensuring adequate life insurance coverage. Some families explore property ownership structures that minimize tax exposure while preserving family control.

However, these solutions require foresight that many families lack until it’s too late. The complexity of tax law means professional guidance is essential, but this creates another barrier for families with limited resources.

“The people who need inheritance tax planning most are often those least likely to get it,” observes tax specialist Linda Foster. “Wealthy families have teams of advisors. Middle-class families figure they’ll deal with it later. But later arrives with a death certificate and a tax bill.”

FAQs

Do all inheritances trigger inheritance tax?

No, most inheritances fall below the taxable threshold and owe nothing.

Can surviving spouses avoid inheritance tax entirely?

In many cases yes, but exemptions vary by location and estate size.

How long do families have to pay inheritance tax?

Typically 6-12 months from the date of death, though extensions may be available.

Can inheritance tax be paid in installments?

Some jurisdictions allow payment plans, especially for illiquid assets like family homes.

What happens if the tax can’t be paid?

The government may place liens on inherited property or force asset sales to cover the debt.

Are there ways to reduce inheritance tax after someone dies?

Options are limited after death, making advance planning crucial for significant tax reduction.