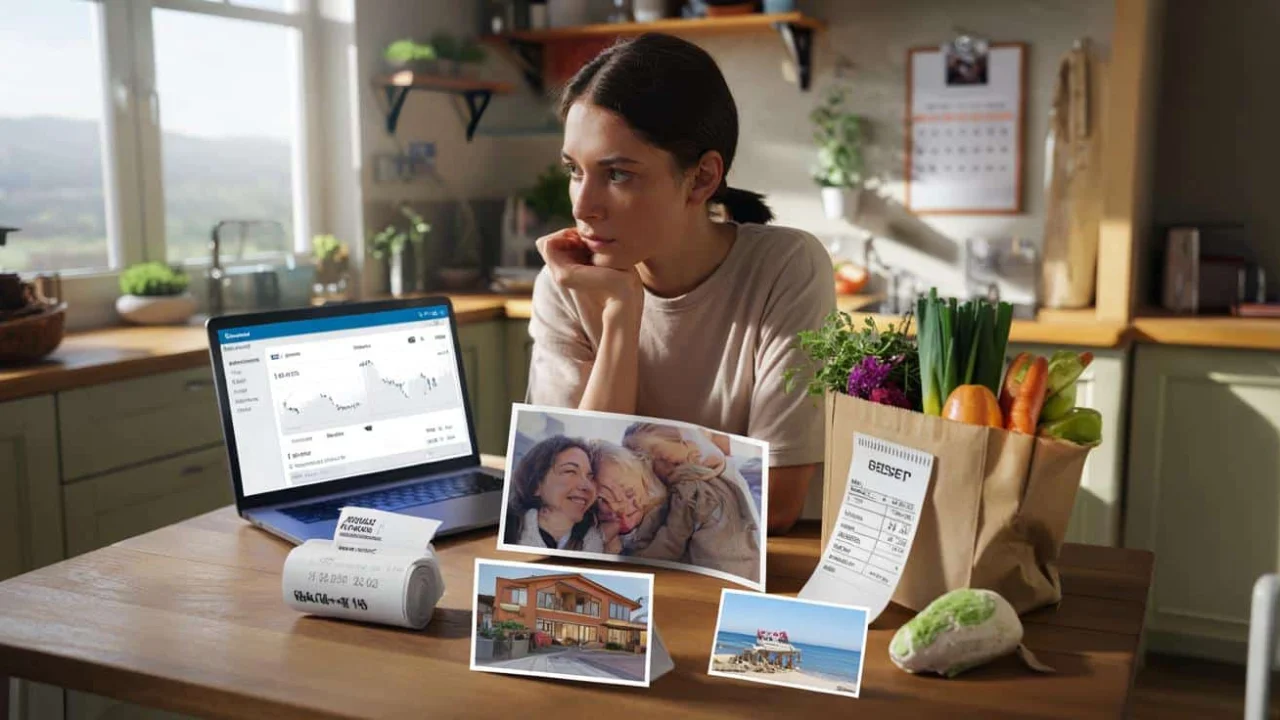

Sarah stared at her banking app, watching the number $2,847 flash on her phone screen. It looked fine. Not great, but fine. She’d seen worse months.

Then her friend texted about splitting the cost of that weekend cabin rental they’d been planning. “It’s only $180 each!” The excitement in those words made Sarah’s stomach drop. Suddenly, $2,847 wasn’t just a number anymore. It was rent, groceries, gas, her student loan payment, and maybe—if she was lucky—enough left over for one night out.

That moment changed everything. The abstract figure became real life, complete with trade-offs and consequences. Sarah had just experienced what financial experts call the “meaning gap”—the difference between seeing money as numbers and understanding money as choices.

Why Our Brains Struggle With Digital Dollars

Financial awareness improves dramatically when numbers feel meaningful because our brains aren’t wired for abstract thinking about money. We evolved to think in concrete terms: “enough berries for three days” or “too cold to hunt.”

Dr. Brad Klontz, a financial psychologist, explains it this way: “When we see $1,500 in our account, our brain processes it as data. When we think ‘1,500 equals three weeks of groceries,’ we’re suddenly making emotional connections that drive real behavior change.”

The problem with most financial tracking tools is they speak in banker language, not human language. They show balances and percentages instead of life impact. No wonder so many people feel disconnected from their own money.

Consider how differently these statements land:

- “You spent $340 on entertainment this month”

- “You spent enough on entertainment to cover your phone bill for three months”

Same information. Completely different emotional response. The second version connects spending to something tangible, something that matters in daily life.

The Psychology Behind Meaningful Money

Research shows that financial awareness improves when people can translate numbers into personal impact. A 2023 study from the University of Chicago found that people who described their expenses in terms of “life units”—hours worked, days of vacation, months of specific bills—reduced unnecessary spending by 23% over six months.

Here’s how different financial concepts become meaningful when reframed:

| Abstract Number | Meaningful Translation | Emotional Impact |

|---|---|---|

| $5 daily coffee | One extra vacation day per month | High |

| $25,000 student debt | Two years of rent payments | Very High |

| 6% retirement contribution | Working 2 fewer years before retirement | Medium |

| $150 grocery overspend | Three dinners out with friends | Medium |

The most powerful translations connect money to time or experiences. Money represents stored energy—hours of work, days of freedom, moments of choice. When we frame financial decisions this way, abstract budgeting becomes personal priority-setting.

“I stopped thinking about my emergency fund as $10,000 sitting in a savings account,” says Maria, a teacher from Portland. “Now I think of it as four months of not worrying about anything. That’s when saving became addictive instead of boring.”

How This Changes Real-World Money Decisions

When financial awareness improves through meaningful context, people make different choices. They don’t just understand their money better—they feel it differently.

Take subscription services. Most people know they spend “around $50-60” monthly on various apps and streaming services. But when they realize that’s “a weekend trip every month they’re not taking,” cancellation rates jump significantly.

The same principle applies to larger financial goals:

- Retirement planning becomes “buying back Fridays in your 60s”

- Debt payoff becomes “earning back your weekend time”

- Investment returns become “years of not worrying about money”

- Emergency funds become “freedom to say no to bad situations”

Financial advisor Jennifer Thompson has watched this transformation countless times: “The moment clients stop seeing retirement contributions as ‘money going away’ and start seeing them as ‘buying future weekends,’ everything changes. Suddenly they’re asking me how to contribute more, not less.”

This shift also affects spending decisions in unexpected ways. People become naturally better at distinguishing between purchases that add to their life and purchases that just subtract from their bank account. The question changes from “Can I afford this?” to “Is this worth trading away three dinners out with friends?”

Young professionals particularly benefit from this approach. They often struggle with abstract financial concepts but immediately understand trade-offs framed as life choices. “When I realized my daily lunch purchases were costing me a week of vacation every year, I started meal prepping the same day,” explains Jake, a marketing coordinator in Chicago.

The ripple effects extend beyond individual decisions. People who develop meaningful financial awareness tend to communicate better about money with partners, set more realistic goals, and feel less anxious about financial decisions. They’ve learned to speak their brain’s native language when it comes to money choices.

Making Your Money Feel Real

Improving financial awareness through meaningful numbers doesn’t require complex tools or advanced knowledge. It requires translation—converting abstract figures into personal impact.

Start by identifying your “life units”—the recurring expenses that matter most to you. Maybe it’s your rent, your grocery budget, or your favorite restaurant meal. Use these as measuring sticks for other financial decisions.

Instead of seeing a $2,000 unexpected expense as a scary number, frame it as “two months of rent” or “eight weeks of groceries.” Suddenly it has context. It’s still challenging, but it’s not mysterious.

The goal isn’t to make every financial decision feel heavy or emotional. It’s to make money feel like what it actually is: stored choice, future freedom, and present possibility all rolled into numbers that too often feel like nothing at all.

FAQs

How do I start making my money feel more meaningful?

Begin by identifying 3-4 regular expenses you care about (rent, groceries, coffee). Use these as reference points when evaluating other spending decisions.

Does this approach work for people who are naturally good with numbers?

Yes, even people comfortable with math benefit from emotional context. Numbers inform decisions, but feelings drive behavior change.

Can this method help with debt payoff motivation?

Absolutely. Instead of focusing on the total debt amount, think about what your monthly payments could buy once you’re debt-free. This creates positive motivation rather than shame.

What if my income is irregular?

Focus on translating expenses rather than income. Think about fixed costs in terms of “days of work needed” rather than dollar amounts.

Is this just about spending less money?

No, it’s about making intentional choices. Sometimes meaningful context shows you that spending more on certain things is worth it because you understand the trade-offs.

How long does it take to develop this kind of financial awareness?

Most people notice a difference in how they think about money within 2-3 weeks of consistently translating numbers into personal context.