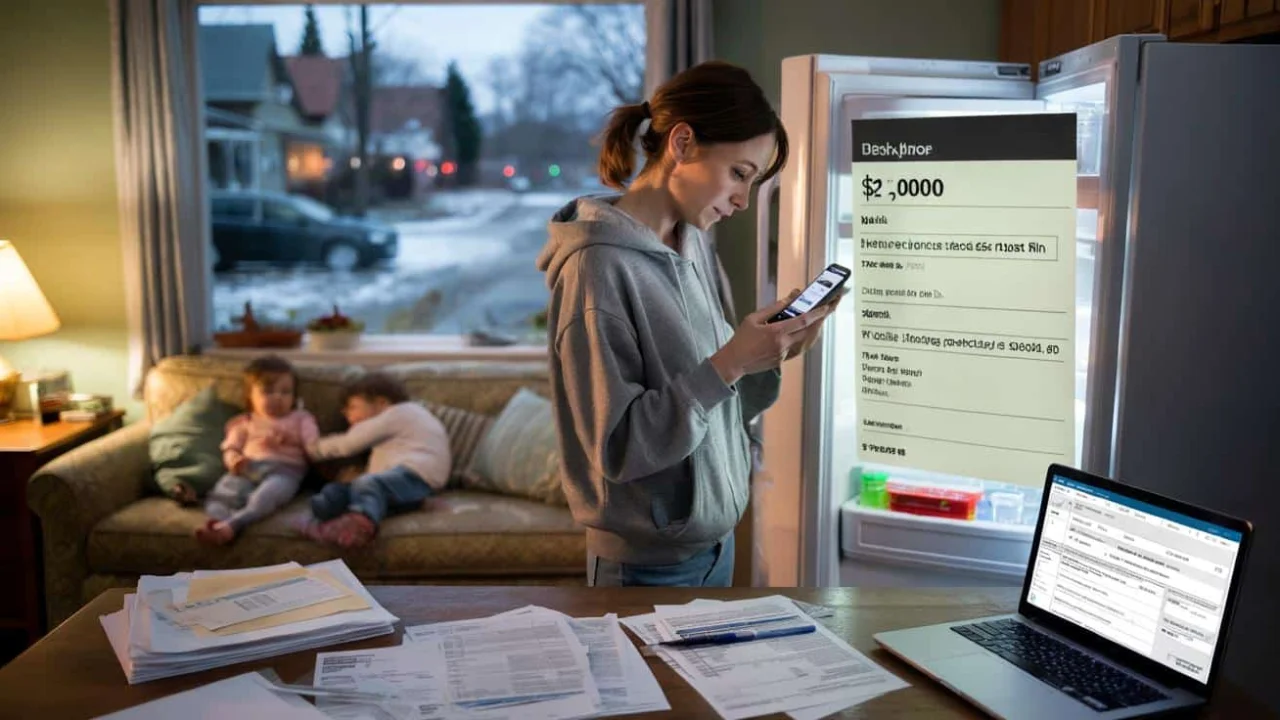

The first time Amanda saw $2,000 land in her bank account overnight, she thought the app had glitched. No side gig, no overtime shift, no desperate credit-card shuffle. Just a clean “IRS TREAS 310” line as she stared at her phone in the glow of the fridge light, trying not to wake the kids.

Outside, February felt long and gray. Rent was due, gas prices were up again, and her tax refund had always felt like a vague promise floating “somewhere in processing.” This time, the money was real, early, and exactly $2,000.

And that specific number is suddenly popping up all over U.S. bank feeds this February. The real question is: who actually gets it?

What’s behind the $2,000 direct deposit wave hitting accounts now

Scroll any social feed right now and you’ll see it: screenshots of bank apps, green highlights on “+ $2,000,” captions like “Check your accounts!!” and “IRS direct deposit hit early.” Some people call it a “$2,000 stimulus,” others swear it’s a new federal program for low and middle-income Americans.

For many, it’s not a special bonus at all. It’s a regular tax refund, a mix of withheld income taxes, child credits and earned income credits, simply arriving as a neat number. The problem is that when money lands with an IRS label, it feels mysterious. Especially in February, that weird month where refunds, delayed bills, and New Year anxiety collide.

Take Jason, a single dad in Ohio, who thought he was getting “some new Biden payment.” What he actually received was his 2024 refund hitting early via direct deposit: $1,250 from over-withholding at work, $600 from the Child Tax Credit, and the rest from the Earned Income Tax Credit.

“The IRS has been processing returns faster this year, and direct deposits are going out in batches,” explains tax professional Maria Rodriguez from H&R Block. “When multiple credits add up to around $2,000, it creates this pattern people are noticing.”

Who qualifies for the $2,000 direct deposit and when to expect it

The timing isn’t random. The IRS follows a predictable schedule for processing returns and issuing refunds, but several factors determine if you’ll see that $2,000 direct deposit in your account:

- Filing date: Returns submitted by January 31st typically process faster

- Direct deposit setup: Bank transfers arrive 5-10 days earlier than paper checks

- Credit combinations: Child Tax Credit, Earned Income Credit, and Additional Child Tax Credit often total around $2,000

- Simple returns: No complex deductions or business income speed up processing

- Previous year filers: The IRS has your banking information on file

The payment schedule breaks down like this:

| Filing Week | Expected Direct Deposit | Check Mailing Date |

|---|---|---|

| January 23-29 | February 7-14 | February 21-28 |

| January 30-February 5 | February 14-21 | February 28-March 7 |

| February 6-12 | February 21-28 | March 7-14 |

| February 13-19 | February 28-March 7 | March 14-21 |

But here’s the catch: not everyone seeing $2,000 deposits is getting a tax refund. Some payments are related to delayed Economic Impact Payments from 2021, state tax refunds, or Advance Child Tax Credit reconciliations that the IRS is still processing.

“We’re seeing a perfect storm of different payment types all hitting accounts at once,” says financial advisor Tom Chen from Northwestern Mutual. “It’s creating confusion because people aren’t sure which program they qualified for.”

How this affects real families and what to expect next

The impact goes beyond just extra cash in bank accounts. For families like Amanda’s, that $2,000 direct deposit means the difference between making rent on time or asking for an extension. It’s groceries for the month, car repairs that have been waiting, or finally catching up on utility bills.

But the timing also creates pressure. February is when many families face their highest expenses: heating bills peak in cold weather states, property tax bills arrive, and holiday credit card statements demand attention.

Jennifer Park, a financial counselor in Seattle, sees this pattern every tax season: “Families plan their whole year around that refund money. When it comes early or all at once, it feels like winning the lottery. When it’s delayed, everything falls apart.”

The $2,000 direct deposit wave also highlights bigger economic realities. Many Americans use tax refunds as forced savings accounts, over-withholding throughout the year to guarantee a lump sum in February or March.

For some families, this money represents their only significant cash influx all year. The Child Tax Credit portions can reach $2,000 per child for families earning under $200,000 annually. The Earned Income Tax Credit adds up to $6,935 for families with three or more children.

The IRS expects to process over 150 million individual returns this year, with about 75% receiving refunds averaging $2,800. Direct deposit users typically see their money 2-3 weeks faster than those waiting for paper checks.

“The system is working better than it has in years,” notes IRS spokesperson Rebecca Martinez. “We’re seeing fewer delays and more accurate processing, which means people get their money when they expect it.”

However, some payments are still delayed. Refunds claiming the Earned Income Tax Credit or Additional Child Tax Credit face extra verification requirements and may not arrive until late February or early March.

If you’re still waiting for your $2,000 direct deposit, the IRS “Where’s My Refund” tool updates daily and shows exactly where your return stands in the processing queue. Most delays involve missing documentation or simple math errors that can be corrected quickly.

The bottom line: if you filed early, set up direct deposit, and qualify for standard credits, that $2,000 deposit might be waiting in your account right now. If not, it’s likely coming within the next few weeks.

FAQs

Is the $2,000 direct deposit a new stimulus payment?

No, most $2,000 deposits are regular tax refunds that include child tax credits and earned income credits combined.

Why is my refund exactly $2,000?

It’s often a coincidence where multiple tax credits add up to round numbers, especially when combined with standard withholding refunds.

When will I get my $2,000 direct deposit?

If you filed by January 31st with direct deposit, expect payment between February 7-21, depending on when you submitted your return.

Can I track my $2,000 refund?

Yes, use the IRS “Where’s My Refund” tool on IRS.gov with your Social Security number, filing status, and exact refund amount.

What if I don’t receive the expected $2,000?

Check for processing delays, verify your bank information was entered correctly, or contact the IRS if it’s been more than 21 days since filing.

Are there taxes on this $2,000 deposit?

No, tax refunds aren’t taxable income since they represent money you already paid to the government during the year.